VAT Returns

Effortless VAT Returns with Cloud-Based Accounting

At Sandsford Accounts, we understand that VAT compliance can be a complex and time-consuming task for businesses of all sizes. Our VAT Returns Service, powered by the latest cloud-based accounting software, ensures that your VAT obligations are handled efficiently, accurately, and on time—so you can focus on growing your business.

Who Can Benefit from Our VAT Returns Service?

- Small and Medium-Sized Businesses – Stay compliant with HMRC while focusing on business growth.

- Freelancers & Contractors – Simplify VAT tracking with our cloud-based solutions.

- E-commerce & Retailers – Manage VAT across multiple sales platforms effortlessly.

- Start-ups & Sole Traders – Get expert guidance on VAT registration and filing.

Why Choose Sandsford Accounts for Your VAT Returns?

- Seamless Cloud Integration

We work with leading cloud-based platforms such as Xero, QuickBooks, Sage, and FreeAgent, ensuring your VAT records are always up to date and fully compliant with Making Tax Digital (MTD) requirements. - Accurate and Timely Submissions

Our expert accountants will review your VAT data, identify potential errors, and ensure your VAT returns are submitted to HMRC accurately and on time, helping you avoid penalties and unnecessary stress. - Real-Time VAT Tracking

With cloud accounting, you get real-time visibility of your VAT position, enabling you to plan and manage cash flow more effectively. - Expert VAT Advice

Whether you’re on a standard, flat rate, margin scheme, or cash accounting method, our team provides tailored advice to optimise your VAT position and ensure compliance with current regulations. - Automated Data Capture

Say goodbye to manual data entry. Our cloud-based software integrates with your business bank accounts and receipt scanning apps, automatically categorising VAT transactions for a hassle-free process.

How It Works

- Initial Consultation – We assess your VAT scheme and software requirements.

- Software Setup & Integration – We set up and connect your cloud accounting platform.

- Transaction Review – Our experts review and categorise your VAT transactions.

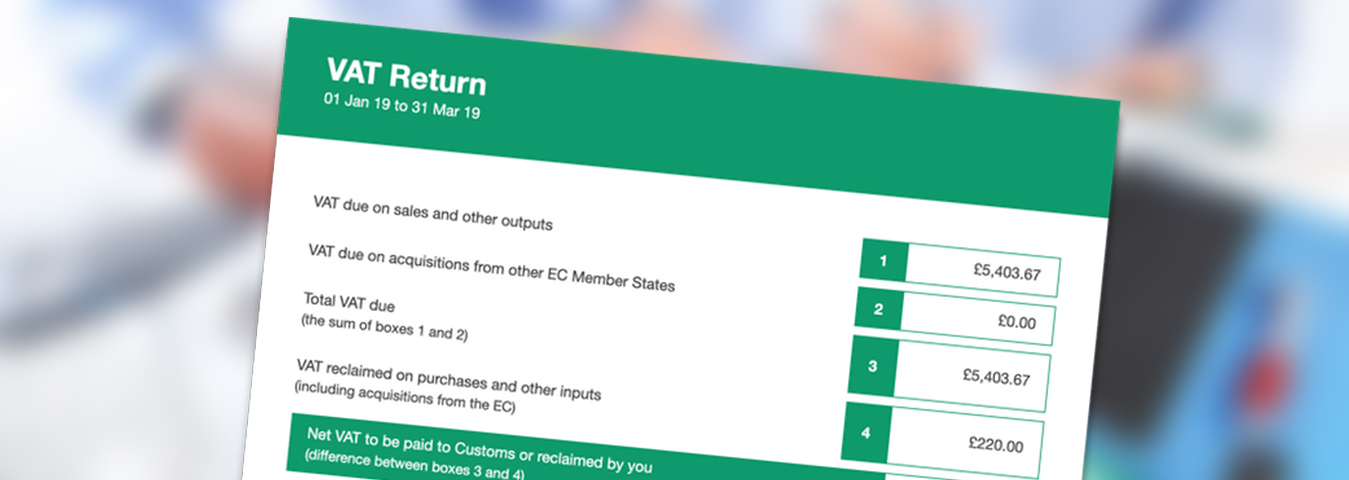

- VAT Return Submission – We prepare and submit your VAT return directly to HMRC.

- Ongoing Support – We provide continuous guidance to keep your VAT records accurate and compliant.

Get Started Today

Don’t let VAT compliance slow you down. Book a free consultation with Sandsford Accounts today and let our cloud-based VAT service take the stress out of your tax obligations.

Bookkeeping Package – VAT Returns Made Simple

If you’re subscribed to our Bookkeeping Package, Sandsford Accounts can offer you this service at discounted rates of just £50 per Return